Unified Identity Verification (KYC/AML) for Community Safety

“Brolly is designed as a trusted community. Identity checks and AML screening help ensure that everyone on the platform is verified—so lenders can have confidence in who they are lending to.”

Who is FrankieOne?

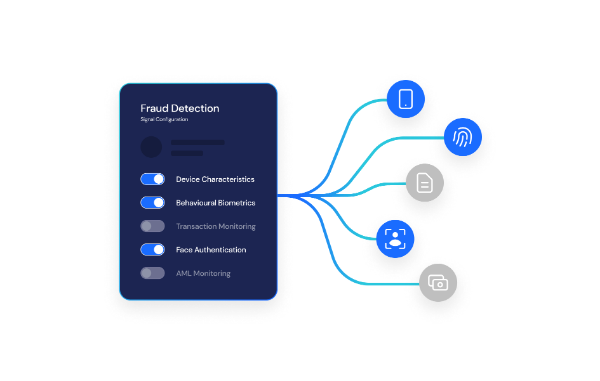

FrankieOne is a RegTech platform that consolidates identity verification, KYC/AML checks, and fraud detection into a single unified API. Instead of Brolly needing to stitch together multiple verification providers and data sources, FrankieOne provides a streamlined verification layer designed to meet compliance obligations while reducing onboarding friction.

How FrankieOne Protects Lenders and the Community

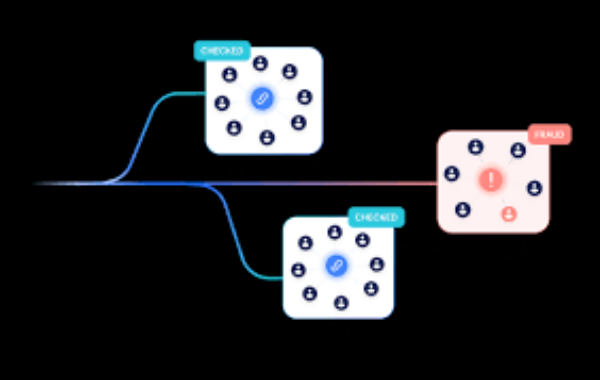

For a peer-to-peer lending community, trust depends on one foundational rule: participants must be real, verified, and screened appropriately. FrankieOne supports that standard by helping ensure that lenders and borrowers are properly verified and risk-screened during onboarding and throughout key lifecycle events.

Key lender-facing benefits to highlight:

Stronger KYC/AML controls to keep bad actors out

Verification and screening processes help reduce fraud risk and deter illicit behaviour. This protects the integrity of the borrower-lender ecosystem and supports compliance expectations.

Fast onboarding without compromising quality

The objective is “rigorous but efficient.” Legitimate users can be verified quickly, while anomalies and higher-risk profiles are identified early. That balance improves growth without weakening standards.Higher confidence that borrowers are who they claim to be

For lenders, this is the direct trust dividend: every borrower is subject to consistent identity and risk checks. You are not lending into an anonymous environment; you are participating in a verified community.