Open Banking Data for Smarter, Safer Lending

Who is Basiq?

Basiq is an Australian open banking API platform that enables applications to securely access financial data from 100+ financial institutions (covering the majority of banks across Australia and New Zealand). Under the Government’s Consumer Data Right (CDR) / open banking framework, Basiq allows customers to securely share their banking information with fintech applications, with explicit consent.

For lenders like Brolly, Basiq provides a high-quality data feed of a borrower’s real transaction history, account balances, income, expenses, and other key indicators. This data helps build a fuller picture of an individual’s financial position in near real time.

How Brolly Uses Basiq to Protect Lenders

Brolly integrates Basiq to make more data-driven lending decisions and manage loans responsibly. In the context of lender-facing communications, the key message is that open banking increases transparency and reduces risk.

1) Better Credit Assessment (Affordability Checks)

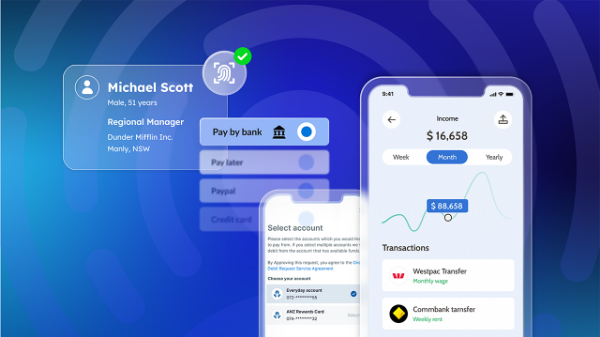

Instead of relying solely on credit scores or self-reported information, Brolly uses Basiq to run comprehensive affordability assessments on borrowers. With the borrower’s consent, Basiq can provide live visibility into income, expenses, assets, and liabilities across linked bank accounts.

This means that before lender funds are deployed, Brolly can validate repayment capacity using actual cash-flow behaviour (for example, monthly income versus recurring expenses) rather than assumptions. This improves assessment accuracy and helps reduce bad-debt risk—directly supporting stronger lender protections.

2) Faster, Seamless Loan Processing

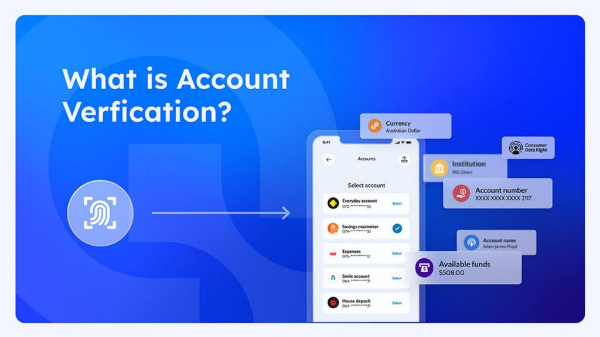

Open banking via Basiq streamlines the application process. Borrowers connect their bank account through a secure portal, and key details can be retrieved and verified quickly, reducing manual handling and paperwork.

For lenders, faster borrower verification and approvals can translate into improved conversion rates, more consistent loan origination, and less “dead time” waiting for verification steps to complete.

3) Secure Payments & Reduced Failures

Basiq can also support the payments workflow (alongside Monoova) by verifying bank account information and checking relevant account conditions before transactions are initiated.

For example, when setting up repayments via direct debit, Brolly can confirm the account is valid and assess whether funds are likely to be available—helping reduce failed payments and dishonour-related issues. The practical outcome for lenders is improved reliability of repayments and more predictable cash flow.

4) Ongoing Monitoring & Early Warnings

Where ongoing access is consented to, Brolly can monitor changes in a borrower’s financial position during the term of a loan. If risk signals emerge—such as income disruption or balances dropping below a critical level—Brolly can identify issues earlier and respond proactively.

From a lender’s perspective, this is a meaningful risk control: the platform can detect deterioration earlier and take action before small issues escalate into defaults.