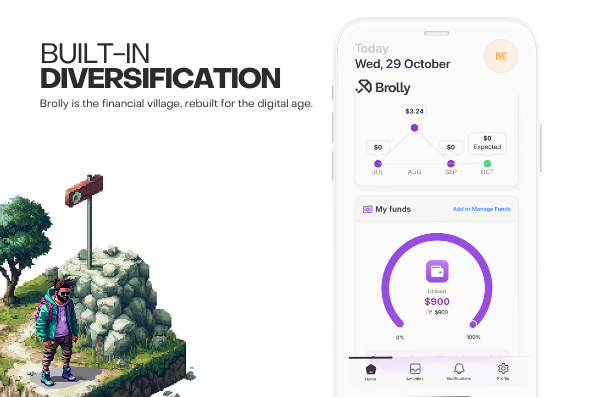

Built-in diversification

Built-in diversification means your funds are spread across many small loans, with simple caps per borrower so no single loan dominates. With permission of the borrower, we read live bank data to check real income and spending, making sure each loan fits the borrower’s cash-flow. That gives better decisions and fewer risky loans—plus faster onboarding with less paperwork and fewer delays (no chasing payslips).

Key Benefits:

Start lending from $100

Interest paid upfront

30-day payouts

Idle funds are liquid 24/7

No platform fees

Free to sign up

Performance Matters:

Historic avg: 14% p.a.

Target: 10% p.a.

Up to: 20% p.a.

Lender losses: 0% to date

Repayment rate: 98%

Smarter Matching

We place your money into lots of small, approved loans with verified people—automatically. You don’t pick or chase; we handle it, and you can watch it all live.

We keep bad actors out. Strong identity checks on both sides of the marketplace.

Smooth sign-up. Quick verification that doesn’t feel like a paperwork marathon.

Peace of mind. Proper compliance records mean a cleaner, safer platform.

Get paid every 30 days: when a loan matures, your principal and earnings flow back to your wallet. The schedule is clear, so you can plan cash flow and line up bills. With one tap, roll into the next cycle or cash out. Live status and alerts show what paid and when.